Why You Should Stop Worrying About High Income & Net Worth And Focus On Passive Income

Jan 16, 2024

In this article I'll be talking about:

- How the financial system programs people to live in scarcity.

- How the biggest financial guru's are not practicing what they teach.

- Why I shifted my business to a passive income model.

- How to escape the financial rat race by building cash flowing assets.

Last year I made the decision to stop doing high ticket coaching in favor of creating a more ‘passive’ business model that allowed for cashflow to consistently come in regardless of if I was present in my business or not.

I was making great money with coaching & consulting, but I realized that if I kept going on the current path then I was enabling myself to trade high dollars for less freedom.

The game is rigged.

We all seek to improve our financial situation by acquiring money. At a basic level it takes care of our needs such as food, warmth, and shelter.

Once that is taken care of, we are free to pursue what we want with more flexibility.

The problem is our financial system is rigged to make us think that the more money we make, the more freedom we’ll have.

Usually, the opposite is true, and we get on that treadmill and chase and chase but never seem to get where we want to go.

The system has been training 98% of us to live in absolute scarcity without most of us even realizing it.

We are taught that ‘money = success & happiness’, so we chase after money like little lab rats on a hamster wheel.

Those of us who live in the United States live in the wealthiest country in the world, or so it seems on the outside.

The truth is, in the wealthiest nation in the world is $34 trillion in debt, or $265,000 per taxpayer.

For the record, it was around $21T around the time of Covid, and about $7T in 2007 when I started worrying about it.

That means it’s accelerating exponentially because no one in leadership understands how money works or its just a big Ponzi scheme to transfer wealth from average taxpayers to the top 1%.

I believe it’s a bit of both, but more of a Ponzi scheme.

Think about what we’ve been told our entire lives from these same people:

If you want to be successful then you need to go to school, work hard, get a degree, and get a good high paying job.

This process costs you years of your life and sometimes hundreds of thousands of dollars and another decade to pay off.

*IF* your degree lands you a high paying job, then you work as much as you can and be highly productive in your best years so that you’ll have enough money for retirement.

We are told to max out our 401k’s and try to create a huge nest egg for that magic day when you retire, and hopefully you’ll have enough saved up to last you for the rest of your life.

If you were 65 today and wanted to have $100k of income in a year, you’d need at least $2.5 million to do so.

Most likely you aren’t 65 and that $2.5 million will be significantly higher when you do get to that point because of inflation. What drives inflation? Printed money, like the $31 Trillion I just told you about.

So, after working your ass off your entire life, you now realize that you’ve got to live with extreme frugality because of the FEAR of running out of money.

Saving an inflation adjusted $2.5 million just to barely get by? No thanks.

Think about it, the financial education that all the big guru’s out there teach (like David Ramsey, Suze Orman & David Bach) is actually teaching you to horde money.

Save it up like a chipmunk saves acorns for a very long winter, make sure you get enough so that you don’t run out.

But what’s even more astonishing is it isn’t even working! The average 65-year-old has around $425k (~ 20%) of the $2.5 million needed to have a decent retirement.

And who are the real winners?

The financial institutions and Guru’s peddling this stuff.

Suze Orman, Dave Ramsey and David Bach are NOT getting rich by doing what they teach people, they are influencers that make passive income from selling bad advice.

𝙏𝙝𝙚 𝙛𝙖𝙡𝙡𝙖𝙘𝙮 𝙤𝙛 𝙝𝙞𝙜𝙝 𝙞𝙣𝙘𝙤𝙢𝙚 𝙖𝙣𝙙 𝙝𝙞𝙜𝙝 𝙣𝙚𝙩 𝙬𝙤𝙧𝙩𝙝:

We always hear about the importance of a high income and a high net worth.

High income = make a lot of money.

High net worth = you’ve saved a lot of money (assets minus liabilities).

We are made to think that high income and high net worth are the same as financial independence.

They are not, and here is why:

The second you shut off your high income, your high net worth starts to erode.

Its like you are pumping up a tire with a big hole in it (expenses). You pump and pump through your career, hopefully adding more air than is leaking out, it gets bigger and bigger, but the second you stop pumping the air starts to leak out.

What is financial independence?

Financial independence is the point where you could live indefinitely without working for money.

That means if you buy into the ‘net worth’ paradigm, that better be a BIG pile o money by the time you retire.

OR you could be creating cash-flowing assets that throw off passive income.

(that’s a little bit of hyperbole, I do believe in savings and not having an ‘or’ mentality but trying to illustrate a point here….)

What seems like an easier task, creating $100k per year in passive income OR a $2.5 million nest egg?

One step back for two steps forward.

Last year after giving up high ticket coaching & consulting, my overall income dropped by about $150k, but my passive income doubled.

I also got back so much more time and flexibility in my life (more freedom).

Think about that for a second, $500 per hour of consulting work is AMAZING, but $100 that came in from a passive source while I was sleeping is even better!

Your action plan:

Keep your biggest source of income flowing in whether that is coaching, consulting or your day job, but start to think about how you can start to create some passive income.

Passive income doesn’t mean that ‘no work’ is involved, it means work up front for a passive stream that keeps on paying when you aren’t there.

Passive income typically builds up slower but later on starts to compound, especially if you reinvest your passive income into other passive streams. Compounding is more powerful than you can possibly imagine but hard to see in the beginning!

Passive income comes from at least one of these 3 sources:

- Your ideas or knowledge (can be physical or digital) - I highly prefer digital, knowledge-based products. Digital products such as an online course, mini course or e-book can be sold over and over, infinitely, with no extra work, little to no start up costs, no warehousing or shipping costs.

- Your money – An easy way to create passive income is to invest in passive vehicles such as dividend paying stocks, peer to peer lending or real estate.

- Your traffic – Using the creator economy, social media, building an email list that you can refer traffic to products you know like and trust. It can also come from sponsorships, ambassador programs, joint ventures.

My favorite way to create passive income:

You’ve heard me talk about Kajabi, the ‘all in one solution’ for coaches & course creators.

With this app I can divert traffic from my social media to my email list that I created with Kajabi.

From here, the ways to create passive income are endless (courses, paid podcast, challenges, events, paid newsletter, affiliate income, having affiliates for your offers).

But you can also create active income as well from the app. The versatility is unmatched.

A quick reminder that I created a free course called Build Your Online Course In Kajabi that shows people behind the scenes of how I use Kajabi and how to boot up the most important parts of your online business in just a few days.

This is available to anyone who uses my affiliate link to sign up for a free 30-day trial.

The course is stacked and shows you exactly how to get booted up quickly but packed with my favorite marketing secrets.

If you are a coach, consultant or other type of knowledge creator, you have the distinct advantage of being able to build passive income up quickly through knowledge based digital products at a very low barrier to entry. Take advantage of it.

I'd also like to remind you to grab my free guide that shows 7 Ways I've Created Passive Income in the last year.

Simon

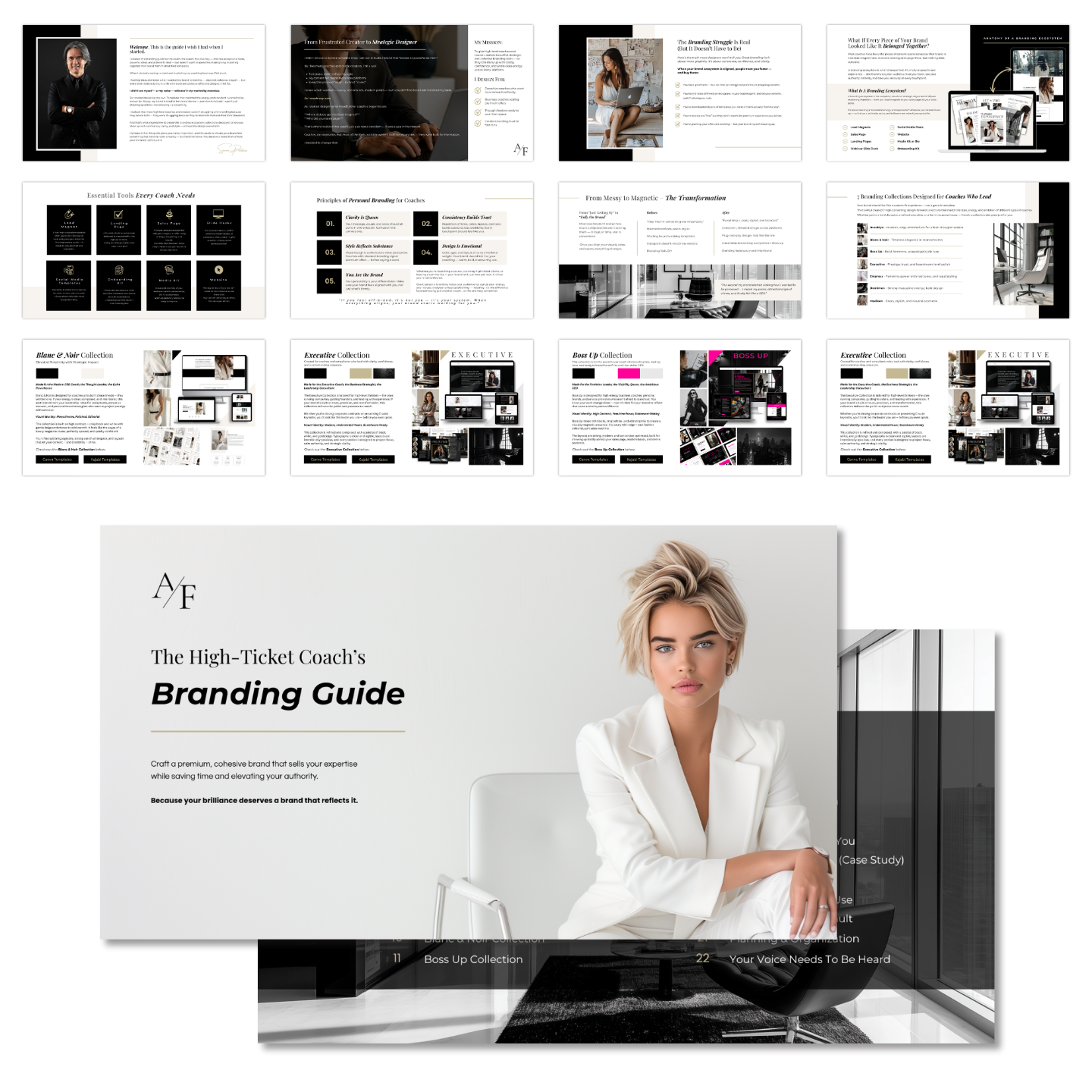

Grab my free High Ticket Coach Branding Guide

A free guide for coaches, consultants, and creators who are ready to ditch the DIY look and step into a cohesive, premium brand presence that sells.

We hate SPAM. We will never sell your information, for any reason.